Philip H. Dybvig

Washington University in Saint Louis

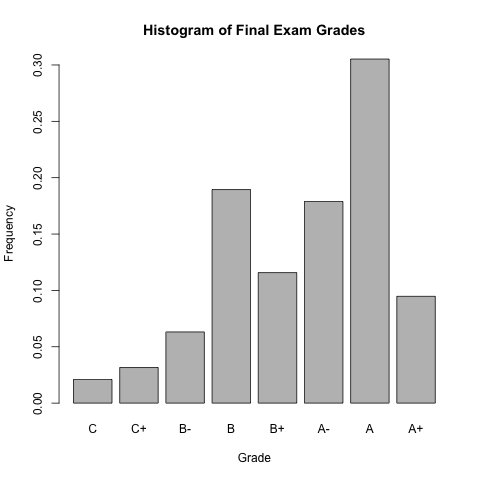

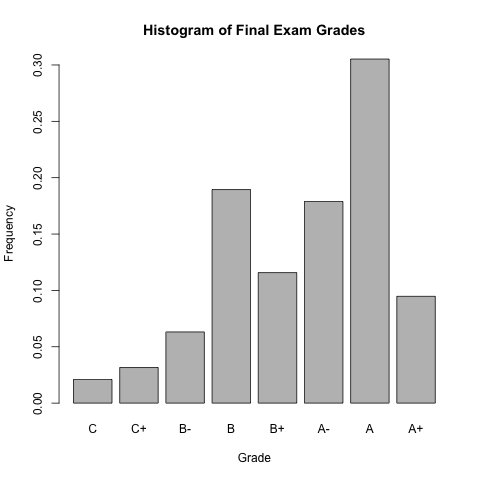

Final Exam Results I was happy overall with the results of the final exam. Scores ranged from 6 to 98 out of 100, with 40% scoring 80 or above. These statistics do not include the students who are taking oral final exams or have a pending academic integrity case.

Final Exam The final exam has been scheduled on Sunday, March 3, 4:00PM-7:00PM. Both sections will have the exam at the same time. The in-person exams will be held in Simon Hall 110, 112, and 113. The TAs will assign you seats for the exam, to avoid the appearance of people choosing seats next to friends to share exam answers.

Here is a practice exam, which was the final exam in Spring, 2022:

The final will have the same format as the practice exam, but of course the questions and topics covered from the course will be somewhat different. Here is a document that gives more detail about what will and will not be covered on the final: howtofinal24.pdf.

Here are some additional exams from 2021. The course coverage was a little different from this time.Important: Exam Rules

Welcome to Mathematical Finance! We will cover some interesting mathematical tools that are very useful in practice, with a focus on applications to investments.

Slides I will use the whiteboard in the classroom. This is a good format for technical material. However, I have also developed a set of slides for your use as supplemental material.

Lecture 1: Decision theory and static choice problems

Lecture 2: Dynamic programming

Lecture 3: Multiple assets, hedging state variables, and pricing models

Lecture 4: FTAP, valuation, and the one-shot approach

Homeworks Here are homeworks you can work to help to learn the material. Although they will not be graded, I urge you to work the homeworks before the TA session when they will be discussed.

Extra Readings I suggest the following book chapter for background readings on single-period models:

Download Dybvig, Philip H. and Stephen A. Ross (2003), Arbitrage, State Prices, and Portfolio Theory, in George Constantinides and René Stulz, ed., Handbook of the Economics of Finance, volume 1b, North-Holland.

There is no textbook for the class, and the class is designed to be self-contained. If you want a textbook for an alternative exposition and coverage of more topics, I recommend the following book:

Back, Kerry, 2017, Asset Pricing and Portfolio Choice Theory, second edition, Oxford University Press.

Kerry is a serious scholar and my co-author. He was formerly at Washington University, but he has moved to Rice University.